Companies are formed by different team members employed at multiple levels — all working under the supervision of the employer. So, an employer needs to have information about its employee to build a team spirit and to thrive towards success. Here, the employee information form comes in.

The employee information form is a simple document from HR that works in coordinating a relationship between an employer and employee. This form ensures accurate recording of personal information of different team members, allowing a clear understanding of the.

It contains the personal information of the employee’s position, experience, and work duration, etc. These personnel information forms can also come in handy in case of an emergency.

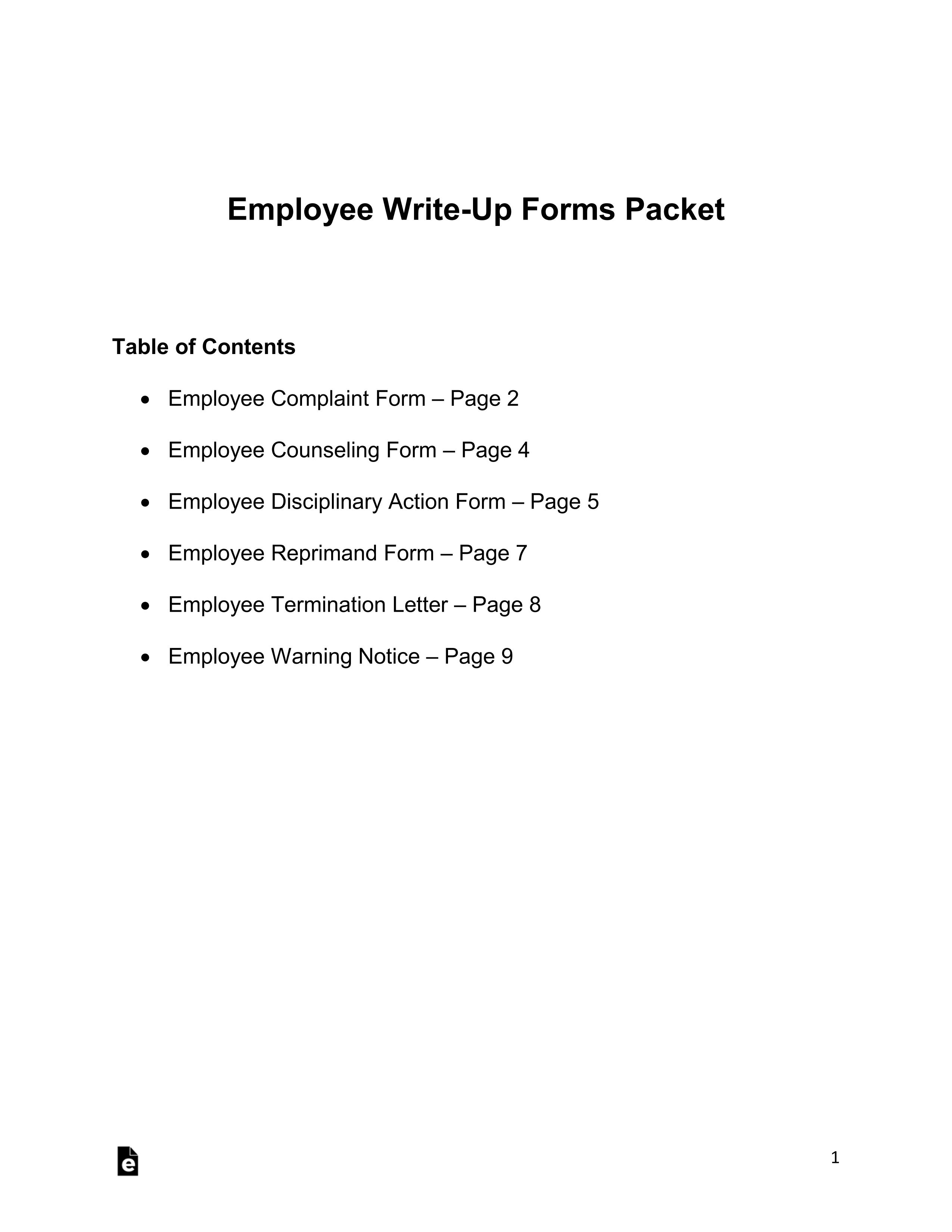

What Are the Different Types of Employee Information Forms?

Employees Information can serve multiple purposes. Hence, it can easily be collected in various forms and types. These forms include but not limited to:

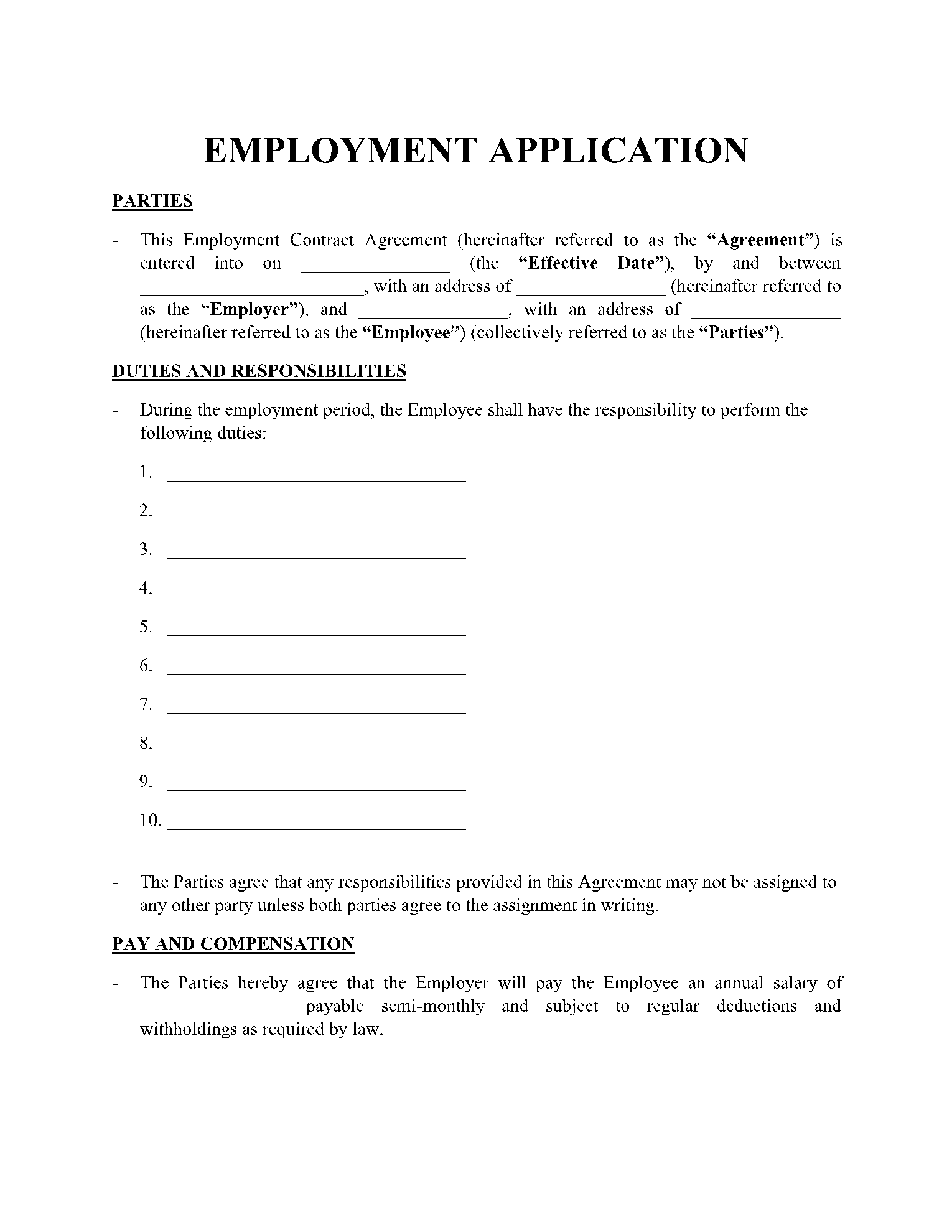

- Employment Application Form: Filled by an applicant when hired for the vacant position.

- Employee Rejection Letter: A formal letter addressing to an applicant that he or she has been rejected for a job opportunity.

- Employee Dress Code Policy: A mechanism to ensure that workers abide by the dress code of the organization as to be dressed properly or in a uniform.

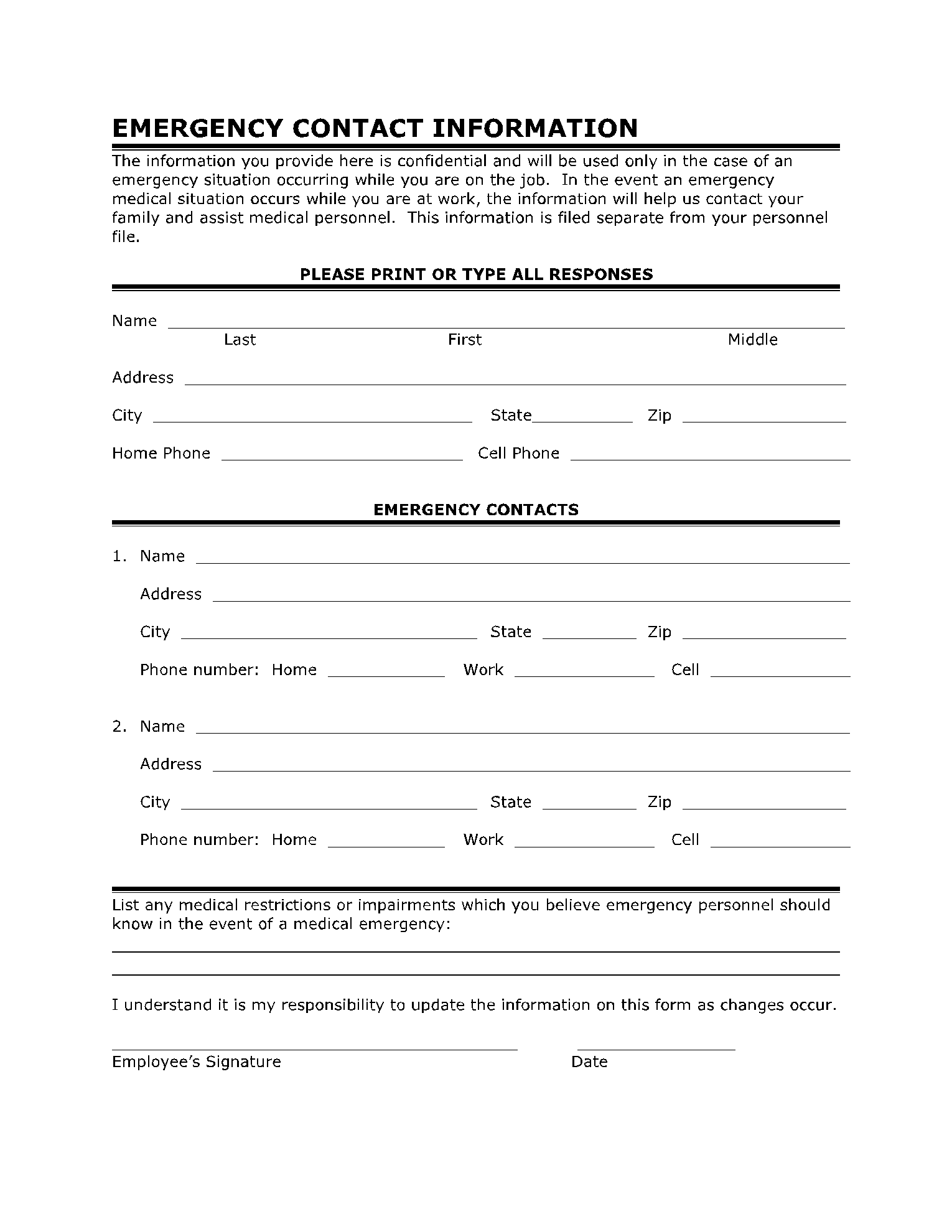

- Employee Emergency Call: To be used by the organization in the event of an emergency to contact family or friends.

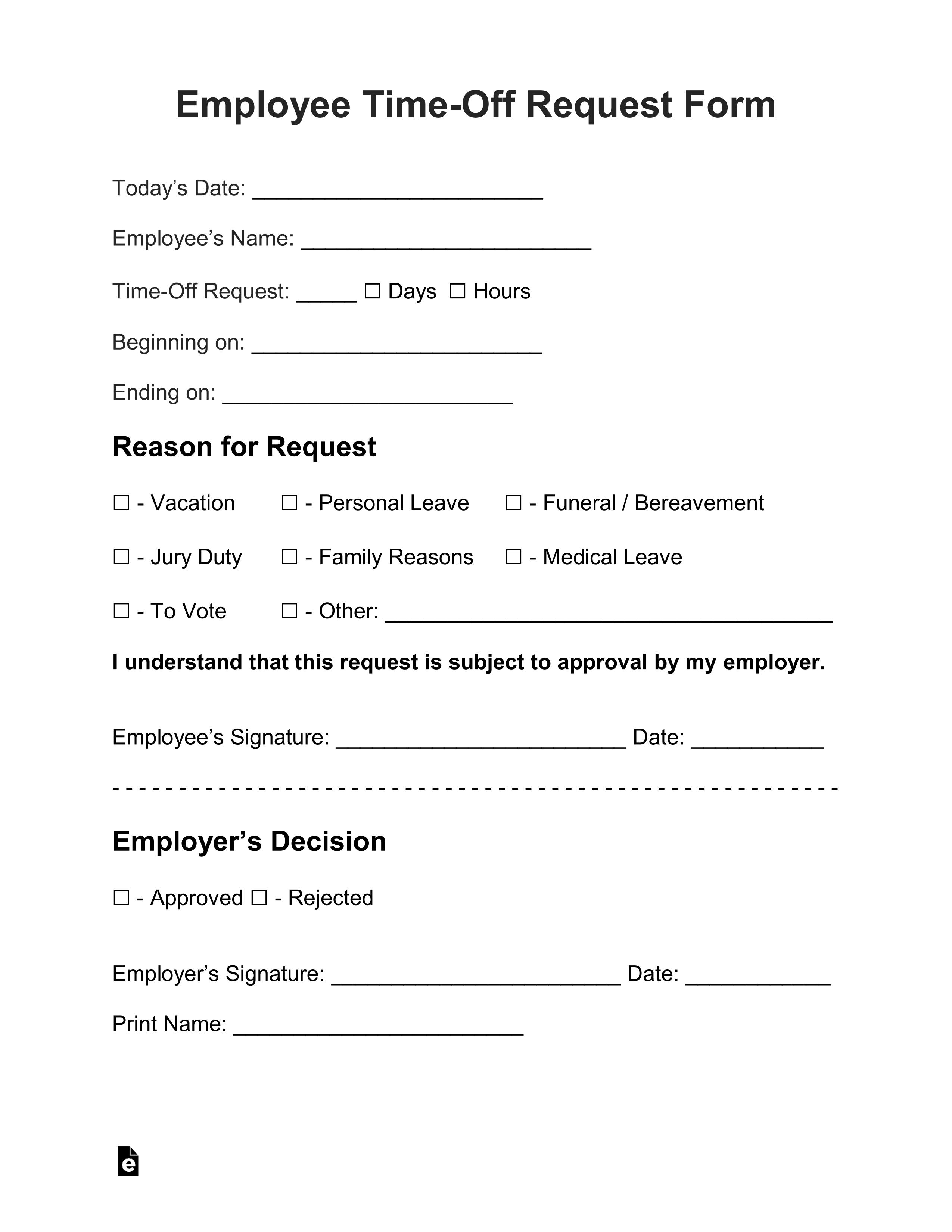

- Employee Time-Off Request Form: This should contain details about time off for vacation, sick days, or some other excuse.

- Employee Onboarding Checklist: A guide that assists a prospective employee in adjusting to the job commitments and obligations.

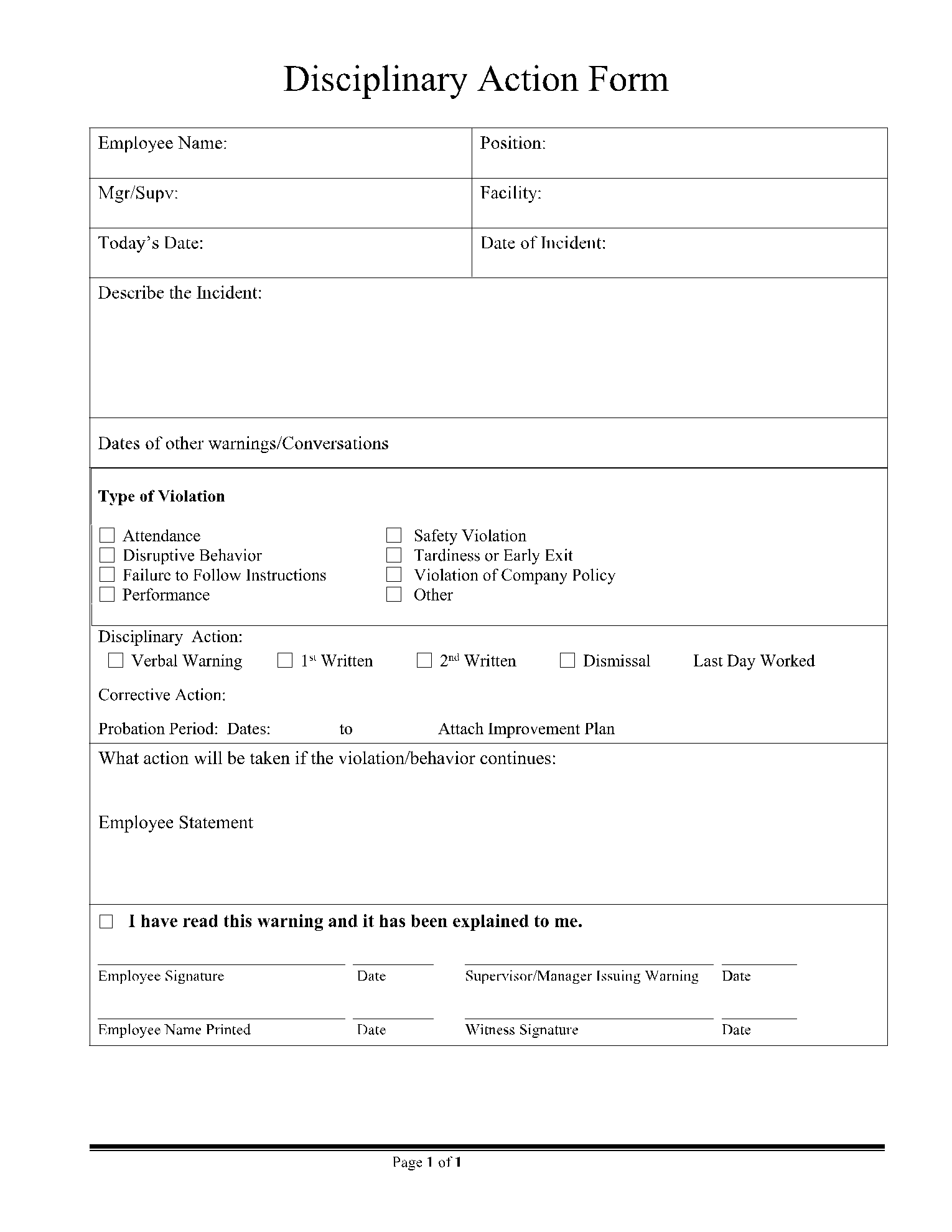

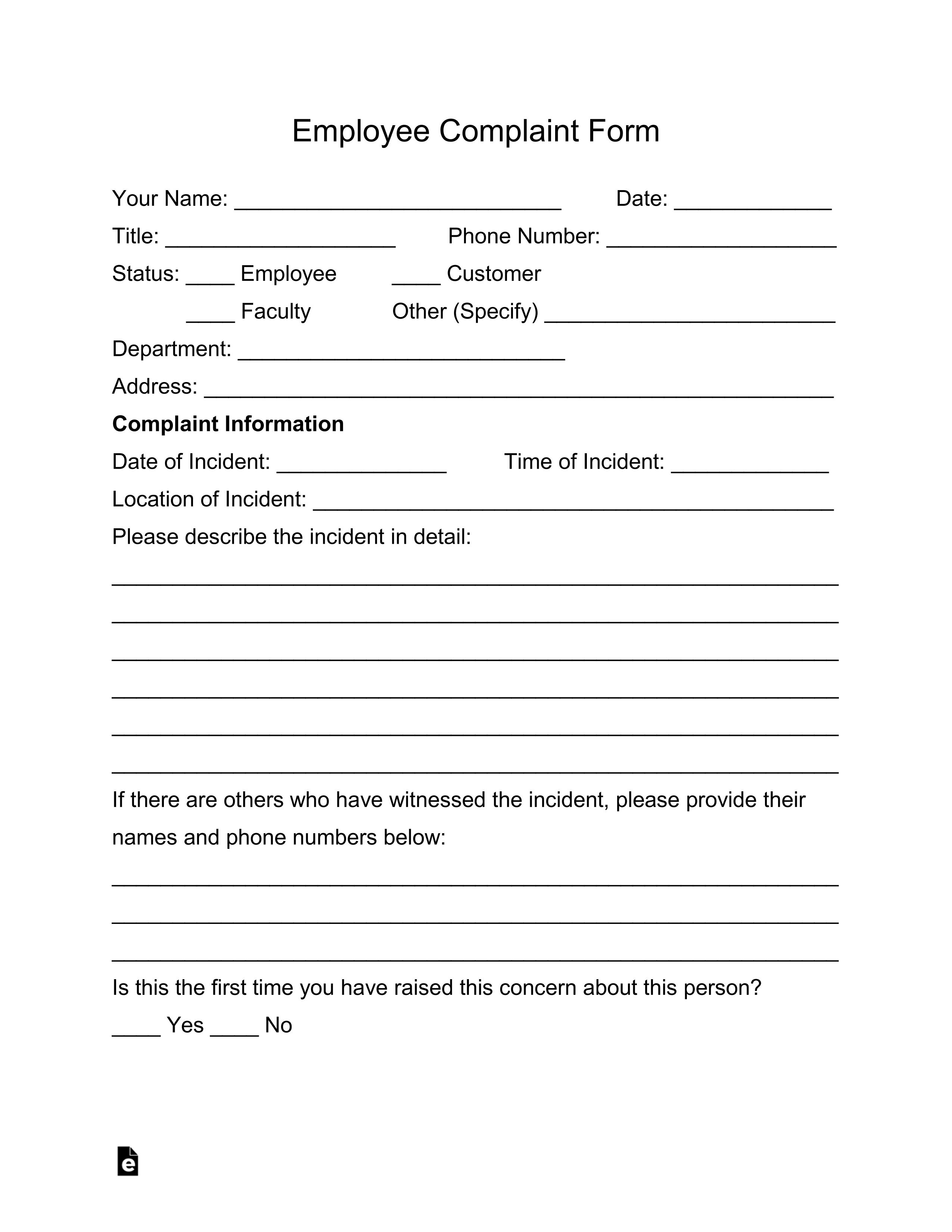

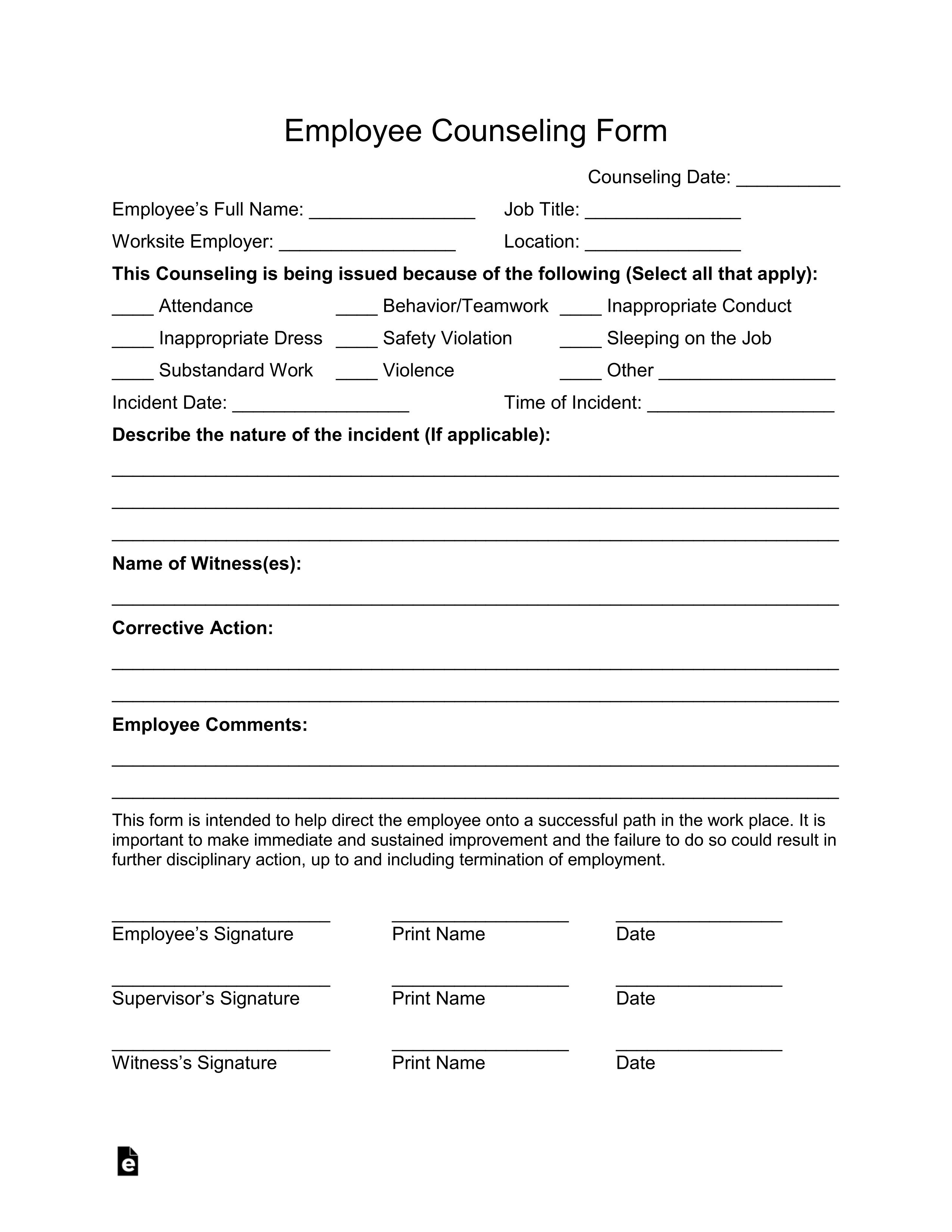

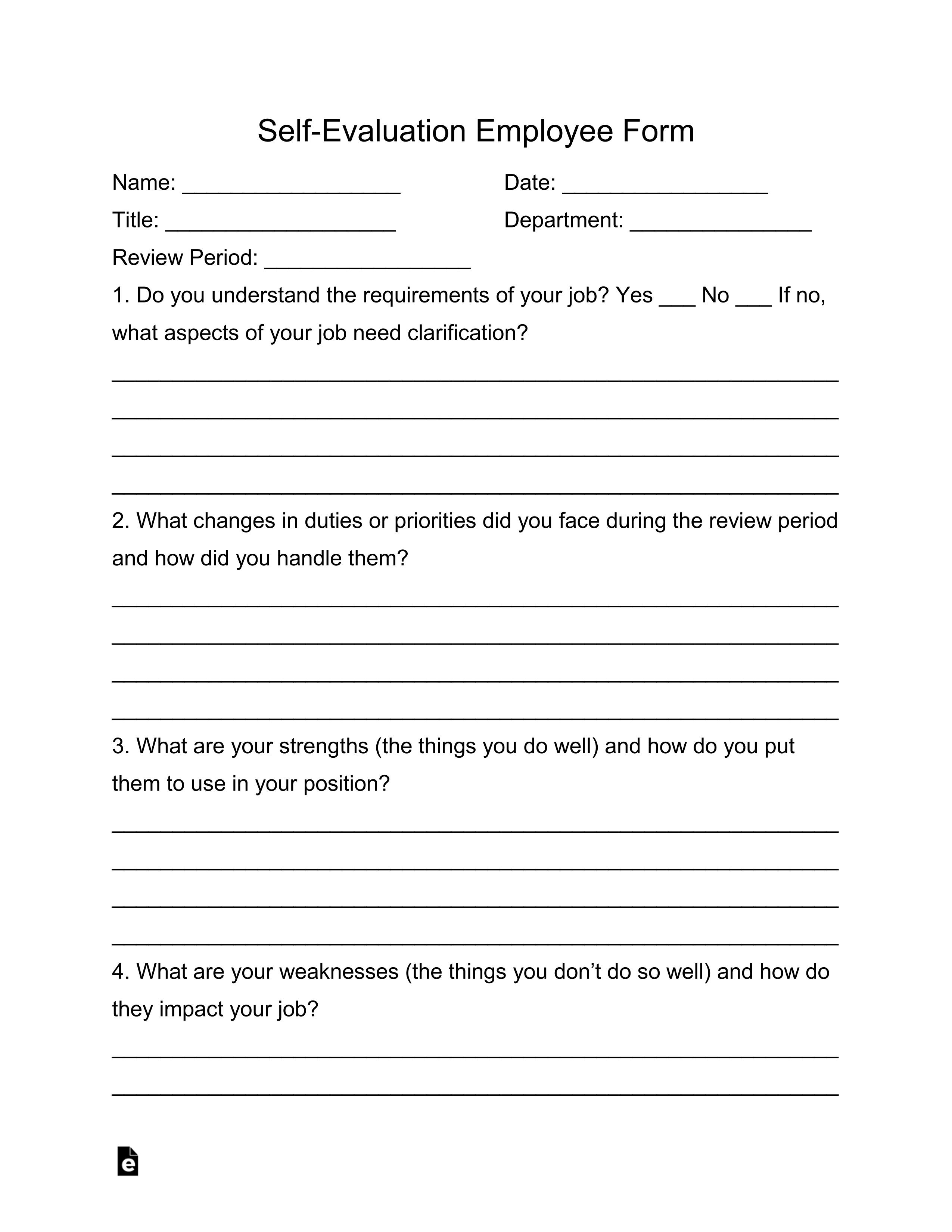

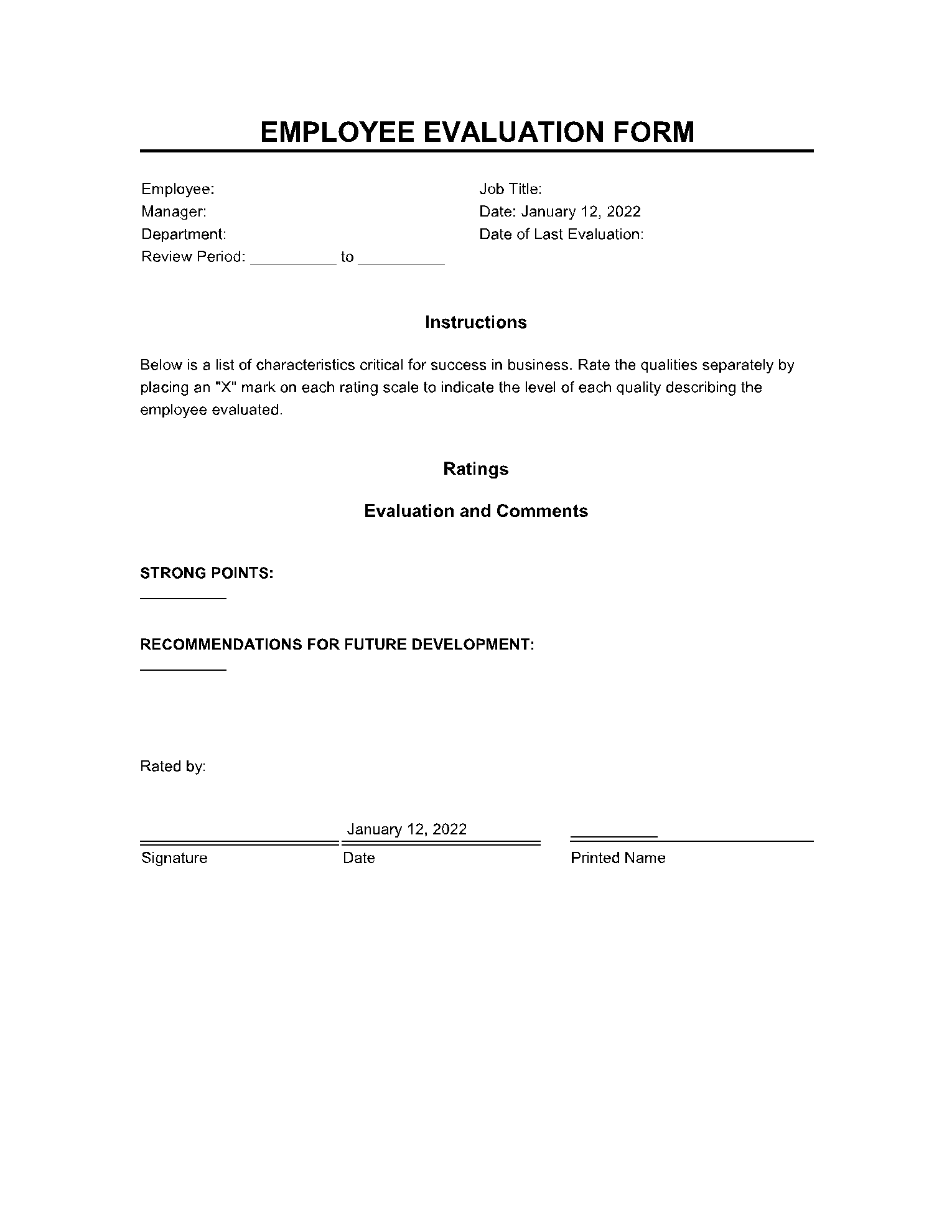

- Employee Evaluation: Analysis of the performance of the employees in the company and their interaction among themselves.

- Emergency Action Plan: Describes other precautions in the case of a workplace emergency.

- Employee Direct Deposit Authorization: Form details out the employee consent to be paid straight into a bank account, with deduction of taxes.

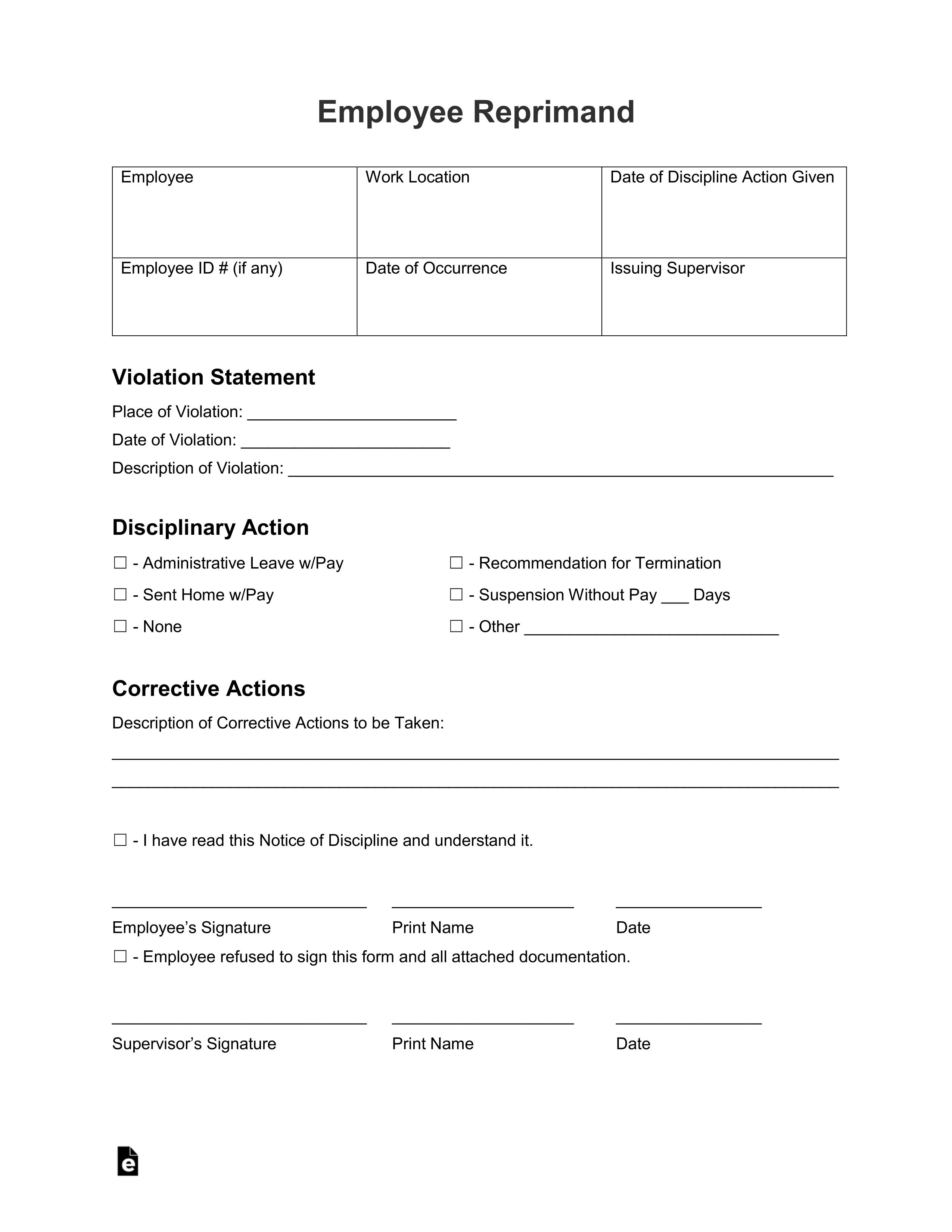

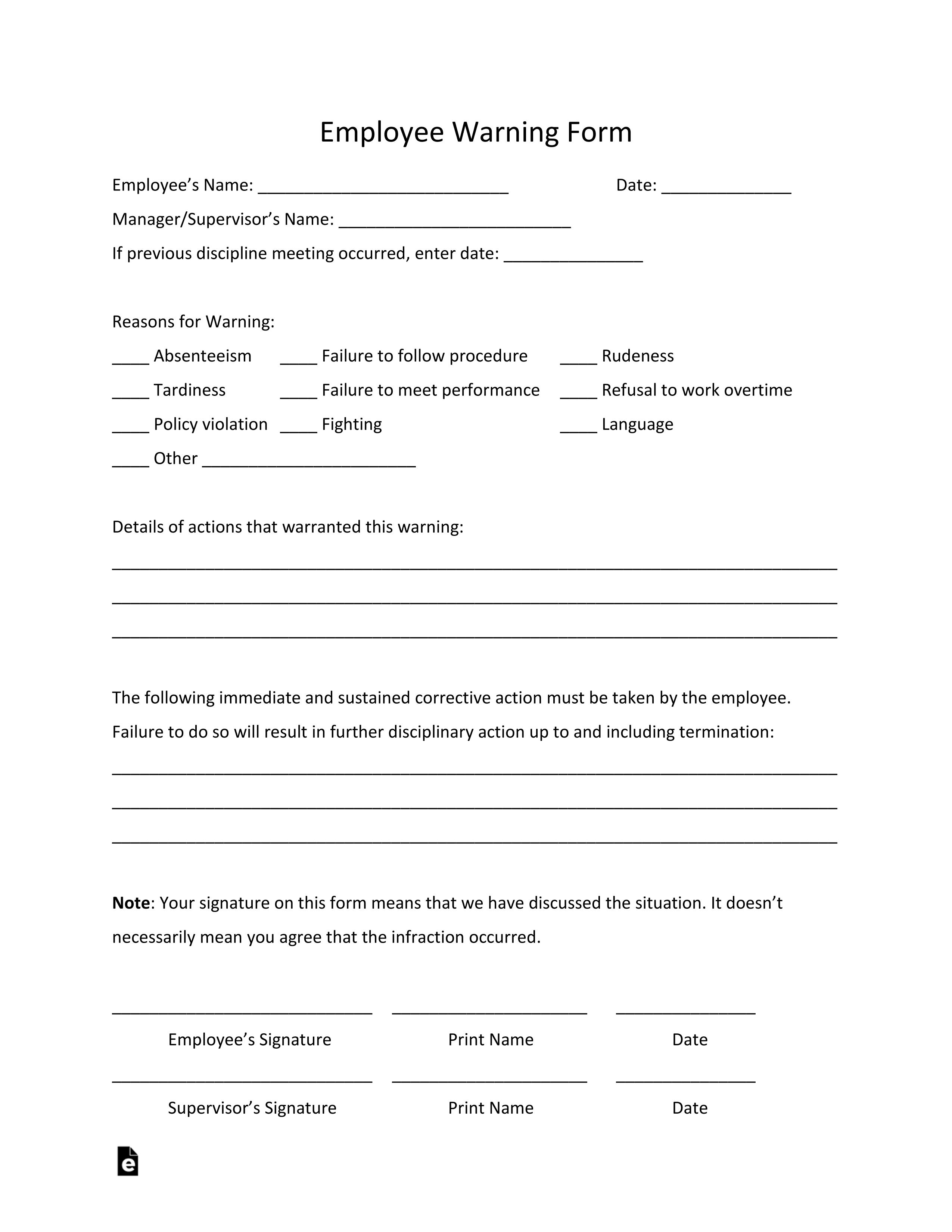

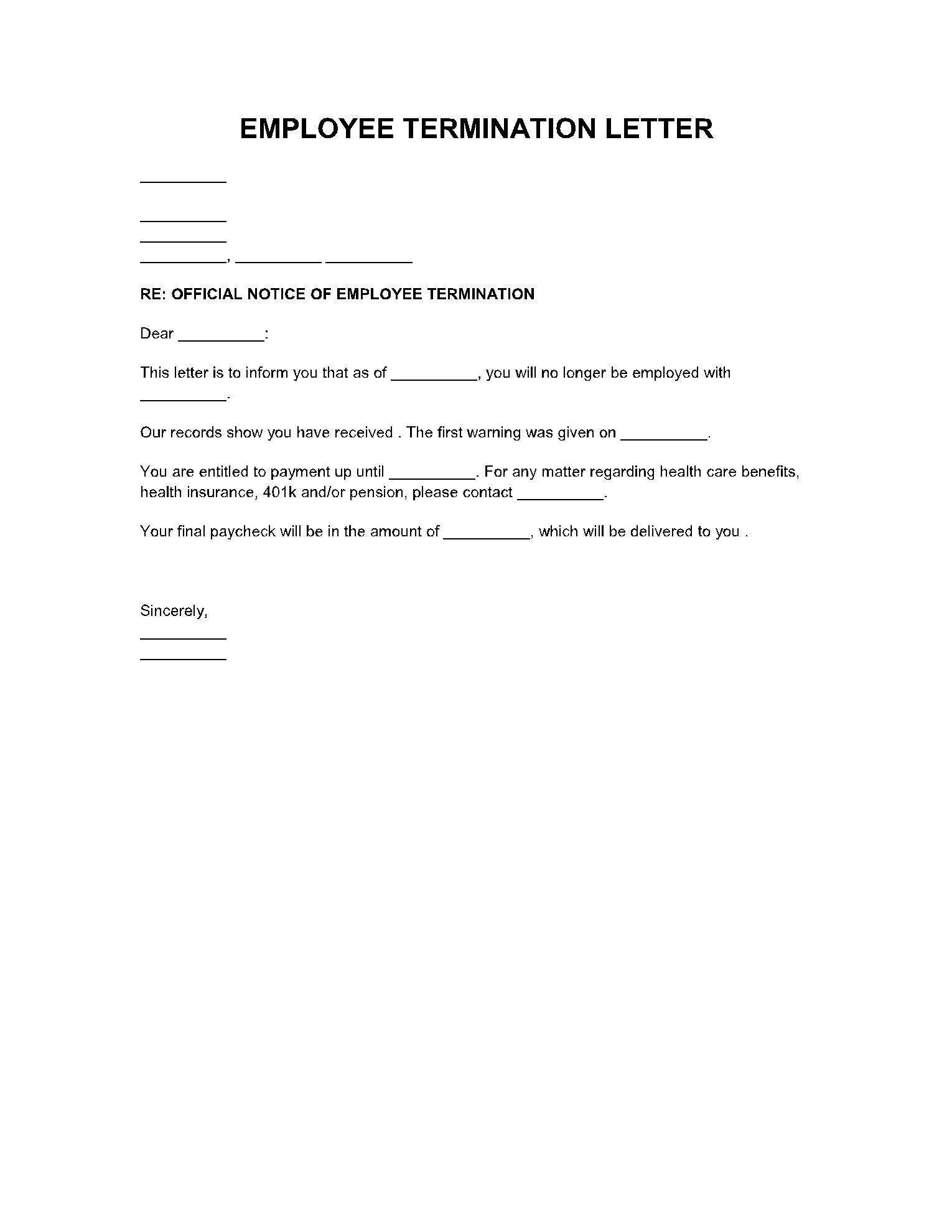

- Employee Termination Letter: To be filled by the employee upon resigning from the workplace with the date and reason.

When Do I Need an Employee Information Form?

The employment information sheet is a very valuable document to build an understanding of the workplace ethics, obligation, and working environment, especially when building a new team. Personnel information forms can be filled by both new recruits or current employees. They are required when there is a need to evaluate the efficiency of the workforce on any project or to observe the performance of any team.

The information can be utilized when hiring a new team for the project. The specific skill set mentioned in the form can be assessed, and an effective team can be put together based on their expertise. Moreover, this write-up form can be filled to ensure workforce security in an emergency, including any disease outbreak.

What Are the Important Parts of an Employee Information Form?

Due to multiple workplace issues, the federal and state laws have put restrictions on what to be or not to be included in the employee information form. These limitations address the general concerns about an individual's race, gender orientation, and even political beliefs. Apart from this, the following are the important parts that must be part of your employee write up form:

- Basic Information: It’s in the employee's best interest to write the full name, date of birth, and social security number. As it is very important to protect the safety of the company from unwarranted individuals.

- Contact Details: Inquire about their home address, home phone number, cell phone number, and email address to reach out while they are not at work.

- Marital Status: In most cases, employees appoint their spouses as beneficiaries of their insurance policies. They must provide details about their partner, such as full name, age, and birth date.

- Employment Information: The employee information sheet must contain the joining date, job position, and assigned department. Also, the information regarding the pay grade should be mentioned.

- Emergency Contact: Contact details of the partner or family member of the employee in case of a medical or another emergency.

- Other optional information: Detail about experiences, skills, interests, and hobbies can be asked if necessary.

Conclusion

Filling out the employee information form is a necessary part of the job application as it conveys all the necessary information about the employee to the company. This employee information can be utilized in numerous ways, including the formation of the team, awarding of any project or contact information for emergency purposes, etc.